Sage Brings Sage 100 Payroll Module Current!

Sage has released the updated Payroll module, bringing it from “legacy” to the “new business platform” and in doing so, introduces many new features and changes.

Valuable Documents and Links

There are several Sage documents posted, some of which summarize and others detail the changes in the Payroll module as well as overview requirements for upgrading. Below are links to the Sage documents we have found most helpful:

- Help your employees understand Federal tax reform impact on their paychecks/withholdings with new IRS tools

- Download Sage 2018 Payroll Upgrade User Guide

- Next Steps for After Upgrading Sage 100 Payroll Post Conversion Tasks

- Sage University Training Sage 100 - Payroll Specialist: Defining Setup Options

- Download RKL's Whats in Sage 100 Payroll 2.0 Webinar Slide Deck

Sage 100 Payroll Implementation Lessons Learned

We also thought it would be helpful to share with you some of the lessons learned in having upgraded installations to the new Payroll module…

1. When upgrading an installation, keep in mind two pointers:

a. Be certain that you are on the most current service update plus any relevant hotfixes available for Payroll. Sage documents in the knowledgebase the minimum service update required for upgrading and continues to release critical hotfixes which may directly impact your upgrade. Do this before migrating data!

b. Once data is migrated from the old version, you must convert each payroll company individually. We recommend you convert all payroll companies before configuring setup in any one company. When you later set the Tax Rule for an earning/deduction code, the system checks other companies for that same earning/deduction code and prompts for using the same setting in those companies as well. This can be a big time-saver!

-- Don’t forget to check each payroll company afterward, looking for any earning/deduction codes which exist there but not in the one you had just configured. You will have to be manually set Tax Rules for those exceptions. --

2. Permissions are driven to a more detailed level, and are configured/managed in the Payroll module in addition to the existing permissions management in Library Master. They must be reviewed and configured before you go much further in the upgrade process. These include:

a. Payroll Department-level access: screens, reporting, and payroll processing.

b. Sage Payroll Notification management

c. Payroll Memo access: Employee, Payroll, and Payroll History

3. Sage has re-architected payroll tax processing in Payroll. It is important you review the different tax elements (groups, profiles, rules) and how they relate to each other.

“Tax rules” are defined by Sage and linked by you to no less than Earning Codes and as required for specific Deduction Codes (such as Section 125 or pretax). The caveat is – tax rules drive specific tax calculations but there is no documentation released by Sage detailing this. To answer the question “How then do I determine which tax rule to apply for a given earning/deduction code?”, use the following approach:

a. Pay attention to the tax rule description listed in the ALE

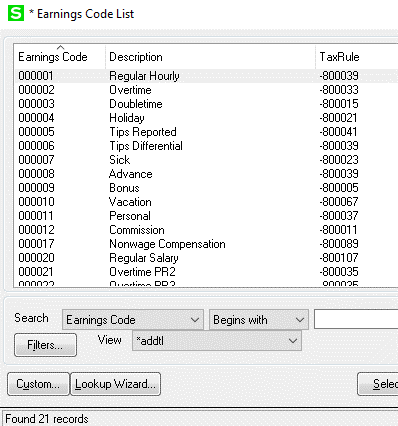

b. Open the PR2 company code (sample Payroll company delivered with Sage 100), open Earning Code Maintenance and modify the lookup to show both Earning codes and their corresponding Tax Rules as applied by Sage for PR2. You can leave this open side-by-side while working in your main company data.

c. Test!! You must test payroll processing and validate tax calculations results. Granted this can be tedious but we all clearly understand the importance of ensuring the setup and results are correct.

4. There are new GL Account fields in Department Maintenance, some of which must be populated for payroll processing to execute even if the given tax account function is not used at the time. An example is “Employer Other” which, if left blank, will generate an error when processing payroll.

5. The new Payroll schema (data dictionary) means all tables have been redefined (new table and field names). Plan for enough time to rebuild custom reports and custom imports/exports. When doing so, keep in mind that with new security in place, PII (“personally identifiable information”) data can only be accessed in reporting via the linking the PII “work” table.

Have Questions or Need Help?

Upgrades require planning, extensive testing and validation, and time allocated for support if needed after go-live on the new version.

Click below to get in touch with us here at RKL eSolutions if you have questions about upgrading your Sage 100 installation to the new version of Payroll 2.0.

Click below to get in touch with us here at RKL eSolutions if you have questions about upgrading your Sage 100 installation to the new version of Payroll 2.0.

Ask a Question