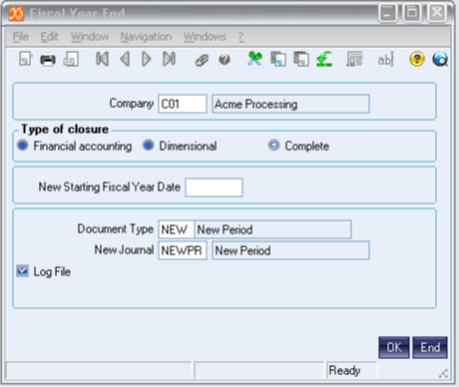

In Sage ERP X3 the Fiscal Year End Closing function FIYEND (Financials > Period Processing > Fiscal Year End) closes a Company's fiscal year and generates the corresponding accounting entries with the document type of NEW. The fiscal year end processing is done on a single screen. Specify the company for which the fiscal year will be closed, the document type and the journal on which the new journal/document/invoices must be generated. The start date for the new fiscal year is automatically displayed. After the process is launched, a log file will trace all processed operations.

Prerequisites

-

Periods(Common Data > G/L Accounting Tables > Fiscal Periods)

All the periods of the accounting fiscal year must be closed.

-

Automatic Journals (Setup > Financials > Accounting Interface > Automatic Journals)

Automatic journal FIYEN and FIYRE must be parameterized.

-

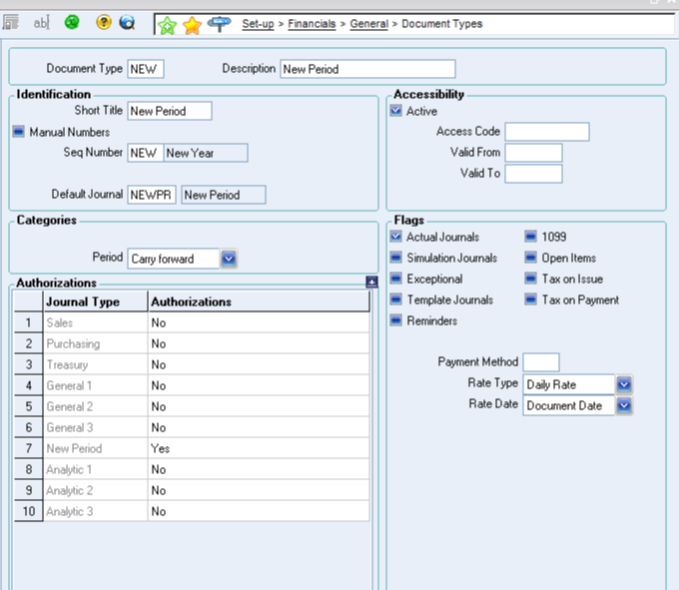

Document Types(Setup > Financials > General > Document Types)

NEW: Must be set to New Period (Default Journal = NEWPR)

Parameter Values

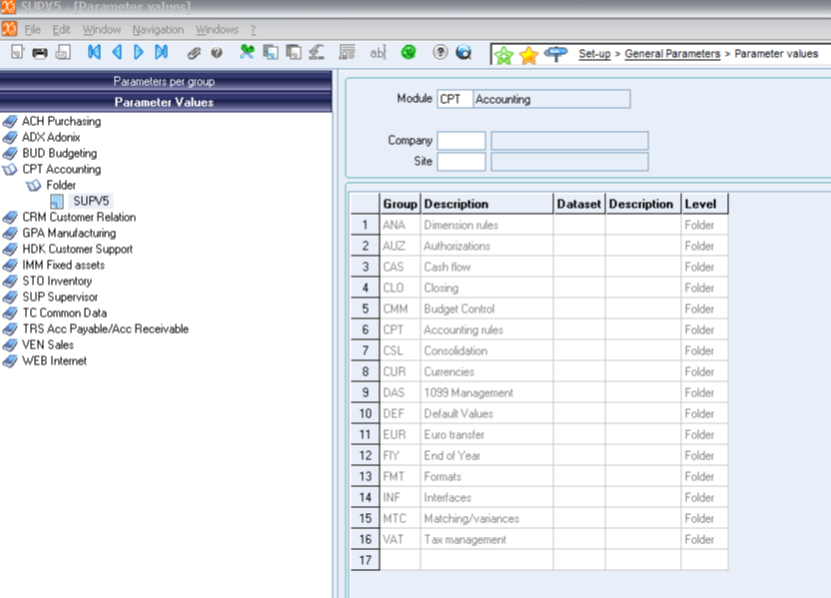

- Definition: (Development > Data and Parameters > Parameter Definitions – expand CPT)

- These parameter definitions are located under the CPT Accounting parameter FIY End of Year.

- Values: (Setup > General Parameters > Parameter Values)

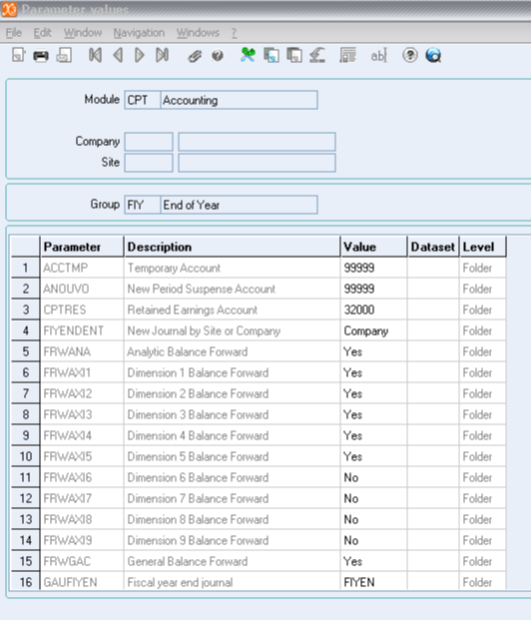

- These parameter values are located under the CPT Accounting Parameter, right click on the FIY Group and select Detail to view the assigned values:October 2009 Sage Page 2 of 5

- FIYENDENT: Specify whether company or site will create the carry-forward journal, document, or invoice.

- ANOUVO: Indicates which suspense account to use for journal entries created in new fiscal periods that result in an unbalanced entry.

- CPTRES: Indicates the retained earnings account.

- FRWANA: Manages the Analytic Carry Forward processing.

- FRWAXI1-9: Indicates, for each dimension (1-9), whether analytical balances will be carried forward from one fiscal period to the next.

Pre-Processing

Items that must be performed prior to closing a year:

1. Set SUP General Parameter ENDDAT to 12/31/xx, where xx is a couple of years in the future.

2. The next fiscal year must be opened prior to closing the current fiscal year.

3. Account classes must be setup correctly (i.e. Expenses and Revenues - Reset to zero, Assets - NO)

4. Verify that NEW is a document type and that NEWPR is the journal code. This should be in the standard X3 system and should never be changed.

5. Execute the Dimension Balance Recovery function if necessary. This function need only be run if the dimension views have changed or new dimension views have been added.

6. All invoices must be validated.

7. All receipts and payments must be validated (Batch Posting).

8. All recurring journal entries must be generated and posted.

9. Final Validation must be performed on all journals prior to closing. This is a batch function within G/L Accounting. This will turn all Temporary journals to Final. Also note that if the company is using Simulation journals, there may be other functions to execute prior to Final Validation such as changing the status of Simulated journals to Actual journals.

10. Price updates for the next year must be entered.

11. Cost transfers/cost calculations must be entered/updated for the next fiscal year.

12. Close all periods for Current Fiscal Year (see Monthly Closing document for items to be performed for monthly closes).

13. All users must be out of Sage ERP X3.

Note: There is a Pre-Closing verification report named CLOPER that should be run before the year-end close is attempted. This report will list out any open items that need to be addressed before a successful year-end close can be performed.

Year End Process

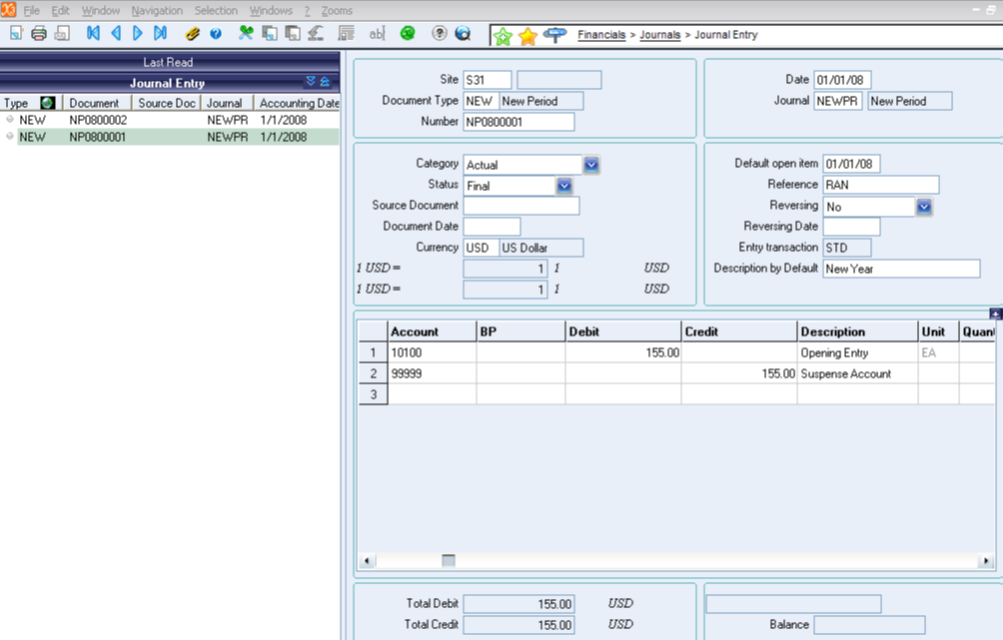

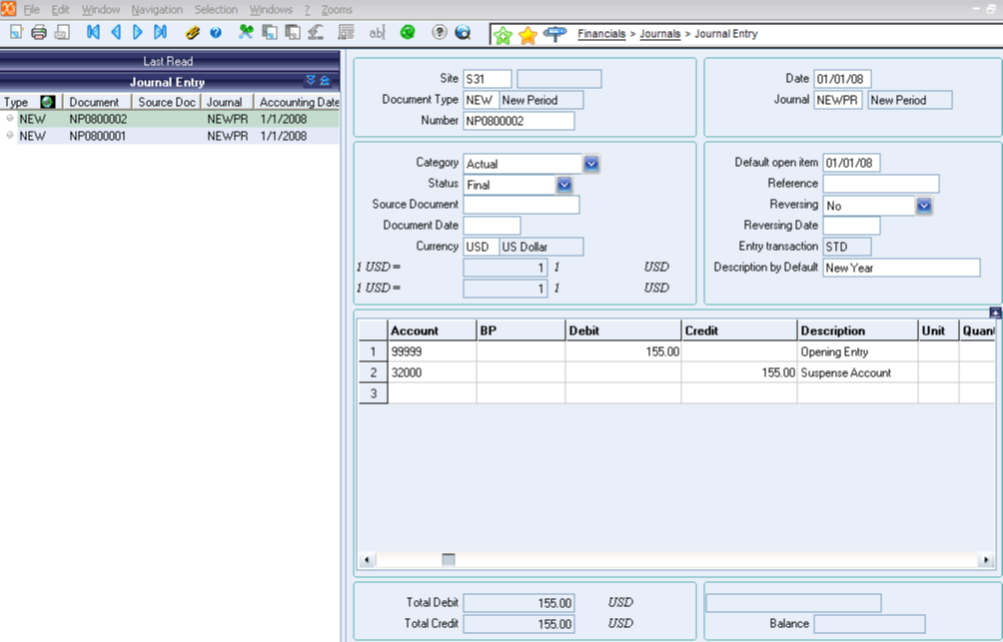

The Year End Process will shut down the Journal Status Monitor. Therefore, when executing Year End, the log displays 2 journals with NEW document types. The first entry closes out the current fiscal year (Rolls forward Balance Sheet account balances and posts the Net Income/Loss to the New Period Suspense account – ANOUVO). The second entry clears out the New Period Suspense account and DR/CR the Retained Earnings account. In order to view the closing journals, the Journal Status Monitor must be restarted.

The two closing journals are referenced below:

For cases where the previous fiscal year must remain open for at least a month into the current year, the Year End Simulation function can be run. This function will roll forward the ending balances for the Balance Sheet accounts without creating the closing journal entries or permanently closing the Fiscal Year. By simulating the close, the monthly statements will include the correct opening balances until the previous Fiscal Year is ready to be closed and retained earnings calculated.