In the recent release of Sage Fixed Assets 2024.1, several significant updates and enhancements were introduced. Here's a summary of what you can expect:

Tax Updates

The release includes important tax compliance updates for U.S. companies. Notably, the maximum Section 179 deduction has increased to $1,220,000 for tax years beginning in 2024. The Section 179 threshold amount is now $3,050,000 for assets placed in service in tax years beginning in 2024. Additionally, the yearly depreciation caps for Automobiles, Light Trucks and Vans placed in service during 2024 have increased. The Audit Advisor is also updated to validate assets for tax years beginning in 2021, 2022, and 2023.

Enhancements

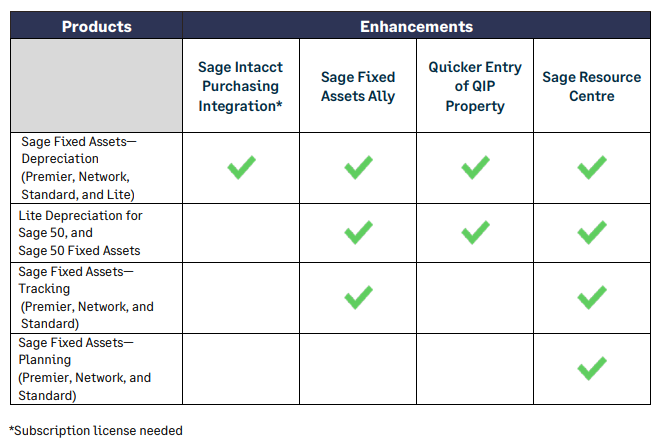

Sage has made several enhancements in this release:

-

Sage Intacct Purchasing module integration: Sage Intacct users can now easily create assets in Sage Fixed Assets from the Purchasing module in Sage Intacct.

-

Sage Fixed Assets Ally: An AI chatbot, Sage Fixed Assets Ally, is now integrated into Sage Fixed Assets to answer your questions faster.

-

Quicker entry of QIP property: The application now defaults to the Estimated Life of 15 years if the Depreciation Method MA100 is selected and 20 years if the Depreciation Method AA is selected. This speeds up the entry of QIP assets.

-

Sage Resource Centre: Users can now access the Resource Centre directly from the Assistance Center or Help menu in Sage Fixed Assets.

Defect Fixes

Several defect fixes were included in this release. These include fixing an issue where a validation error occurred during Custom Import, an issue with the Transfer 168-in and Transfer 168-out fields for a Transfer not being fully cleared after deleting the Transfer transaction, and an issue where only the last partial disposal was displayed when running Print Asset Detail for Disposals when the asset had multiple partial disposals.

Crystal Reports compatibility

Sage Fixed Assets 2024.1 uses SAP Crystal Reports runtime SP30. Users may experience a compatibility issue after upgrading to Sage Fixed Assets 2024.1 if they later install (or reinstall) Sage 500 on the same machine. If this occurs, users can review Knowledgebase article 221924660118149 for steps to resolve the issue.

These updates and enhancements aim to improve the user experience and ensure compliance with the latest tax laws. Sage encourages users to provide feedback, especially on the new Sage Fixed Assets Ally feature.