We may think of the future as a far-distant time from now—10, maybe even 20 years down the road. Not so. Fast-evolving technology is quickly blurring the line between the present and the future. What was recently science fiction is quickly becoming science fact, and exciting new technologies are continually impacting how we work today.

In particular, three upcoming technologies will dramatically change the face of the finance and accounting profession—blockchain; robotics; and 5G, the next-generation of wireless technology. Roles will shift, redundant processes will be automated, and organizations will have the opportunity to re-imagine jobs in ways never thought possible.

Blockchain: Say farewell to the middleman

Today, most of our financial transactions involve a third party, like a bank. When I write a check, the recipient deposits it in their account. It’s up to our respective banks to clear those transactions and move those dollars. Then we each record the transaction in our separate checkbooks.

Blockchain technology eliminates the middleman—in this case, the banks. People or organizations can directly share transactional information. To pass money, I simply give instructions to move value from my blockchain ledger account to that other person’s account. Instead of two separate checkbooks, we can both access and view the transaction in what I like to call a “global shared spreadsheet.”

»Learn more about blockchain and ERP

In more formal terms, blockchain is a shared, distributed ledger (or database) for creating an immutable record of transactions. Blockchain maintains a continuously growing list of ordered transactions called blocks. Each block contains current transaction information, a timestamp and bits of the previous block. Once recorded, data in a block cannot be altered.

Through the use of peer-to-peer networks and a distributed timestamping server, a distributed blockchain database is managed autonomously.

Since blockchain is distributed, there could be hundreds or even thousands of copies of this ledger/database. This sheer number makes blockchain virtually impossible to hack, since each version would have be accessed. The use of public and private encryption keys further enhances security. The same Internet we use now will serve as the infrastructure for blockchain—consider this technology the “Internet of Value” or Web 3.0 (Web 2.0 is the Internet of Information).

The first widespread use case for blockchain was Bitcoin crypto-currency, which was implemented in 2009. While the technology itself is not new, its potential applications are limitless—extending far beyond crypto-currency or monetary transactions that replace checks and credit cards. The transactional value can be any type of asset transfer - physical ones such as cars, precious metals or gems, and real estate; digital assets like music, images, and gaming, or a vast array of intangible assets, including securities, patents, IP, medical records, and identity management. The possibilities are almost limitless. Where there’s value, blockchain can play a part.

The first widespread use case for blockchain was Bitcoin crypto-currency, which was implemented in 2009. While the technology itself is not new, its potential applications are limitless—extending far beyond crypto-currency or monetary transactions that replace checks and credit cards. The transactional value can be any type of asset transfer - physical ones such as cars, precious metals or gems, and real estate; digital assets like music, images, and gaming, or a vast array of intangible assets, including securities, patents, IP, medical records, and identity management. The possibilities are almost limitless. Where there’s value, blockchain can play a part.

As you might well imagine, blockchain will have a significant effect on any party who sits in the middle of a value transaction. Banks and credit card companies, for example, are at risk for being disintermediated or even eliminated from the value chain. According to a report by PwC, 90 percent of payment companies plan to adopt blockchain as part of a production system by 2020. Leading financial institutions and other organizations are learning to adapt to and adopt the new technology, looking for ways to bring value to their customers and be successful, even as their roles change.

The rise of the robots

Want pizza delivered to your door? Forgot to pack your toothpaste? Need your financial processes automated? There’s a robot to assist you in each of these scenarios. Indeed, this technology is—and will continue to—infiltrate all areas of our lives.

Finance and accounting, in particular, are on the verge of being dramatically affected by robotic technology. I don’t mean a C-3PO-like figure filing invoices or signing checks. I’m talking about robotic process automation (RPA)—virtual robots, software algorithms that are programmed to imitate the keystrokes humans make in completing a process.

Finance and accounting, in particular, are on the verge of being dramatically affected by robotic technology. I don’t mean a C-3PO-like figure filing invoices or signing checks. I’m talking about robotic process automation (RPA)—virtual robots, software algorithms that are programmed to imitate the keystrokes humans make in completing a process.

RPA software is not as complicated as it might sound, nor is it that expensive. “In the past couple of years we’ve seen quite an uptake in companies wanting not big, transformative process reform, but very tactical reform to get a rapid ROI with a very low-risk solution,” Craig Le Clair, a vice president and principal analyst at Forrester Research, told CFO magazine.

Many redundant financial and accounting tasks and processes could immediately benefit from automation. A PwC spotlight lists some capabilities that RPA software can perform:

- Automated data entry

- Multi-system integration

- Repetitive tasks

- Process reconciliation

- Data validation/quality

- Processing simple business rules

A process that is ripe for automation is accounts payable. Even though many people automate payments in their personal finances, that same discipline has largely been ignored on the business side. From opening the invoice to matching it to a P.O., to routing it for approval then cutting a check, the AP process uses a lot of paper and consumes a lot of work hours. AP automation software, such as AvidXChange, completes nine out of the 12 steps in the process for you, saving time, improving customer service levels, and freeing employees to perform more valuable tasks.

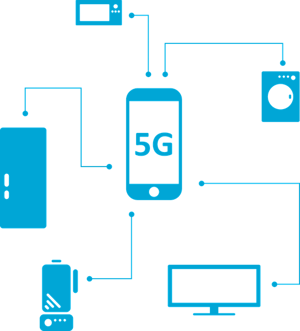

5G: A whole new generation of possible

5G is the next generation of wireless communication technology. The 5G standard itself should be finalized in 2018, with full commercial rollouts and incorporation into smart mobile devices in the 2019/2020 timeframe. With ultra-reliability, low latency, massive M2M connectivity, and enhanced mobile broadband, 5G will transform our personal and professional lives. Billions of devices will be able to connect and communicate in real time, generating massive waves of  new data.

new data.

Consider the following use case data requirements:

- Autonomous driving: 1 GB/second

- “Smart” hospital: 4,000 GB/day

- Connected factory: 1 million GB/day

Only 5G has the scale and scope to enable new insights, drive business efficiencies, and create data monetization in this brave new world.

Is your firm future-ready?

These and other technologies will transform the way you work and live. Success depends on your business’s ability to adapt to and adopt new technology. Use it to automate redundant business processes, offer new and innovative services to your clients, and most of all, re-imagine the workplace to fully embrace your organization’s and employees’ priorities.