An article by Bill Gerneglia appeared recently at myCIOview on the very topic of CFOs and return on investment (ROI) for IT investments.

One of the comments that took me by surprise was this:

"[T]he ROI projections for major IT initiatives are often wrong."

What took me by surprise in this statement was—cynic that I am—that there were, in fact, "ROI projections for... IT initiatives" at all! For, indeed, these projections had to exist before they could be wrong. And, sadly, a great many of the IT initiatives with which I have been involved over the years never had (to my knowledge) any formal ROI projections prepared for them in advance of the project at all. Nor, apparently, did the C-suite have any real interest in preparing such formal ROI projections.

Separating IT Investments from Operating Expenses

So, let us consider when and why an IT initiative should be considered an "investment" versus the conditions under which an IT initiative should be properly labeled as an "operating expenses."

The "simple rule," I believe, should be this: any IT initiative aimed at maintenance of current operations should be labeled as an "operating expense" (OE) project and monies paid out for such a project should not be subjected to any kind of ROI analysis.

Examples of such OE projects might be:

- Upgrading or replacing hardware due to age or obsolescence

- Upgrading or replacing operating systems due to age, compatibility requirements or obsolescence

- Relatively minor upgrades or updates to software due to age, compatibility requirements or obsolescence

- Upgrading or replacing technical infrastructure components and systems due to age, compatibility requirements or obsolescence

- The addition of new infrastructure, systems and software as the result of normal operational growth (such as the addition of new personnel) not the result of any other corporate initiative and investment aimed at stimulating such growth

So, "What's the simple rule for seeing an IT initiative as an 'investment' versus OE?" I hear you ask.

That's pretty easy.

As soon as you hear someone or some department say something like the following, you should be getting out your ROI calculator and putting it to work:

"If we [speaker describes an IT initiative], I'll bet we would [speaker describes how business would be sell more, save money, or reap some other benefit]."

By the way, sometimes the speaker of the above sentence is the hardware vendor, software vendor or a value-added reseller. In such a case the statement probably sounds a bit more like this:

"If YOU buy [or, more subtly, 'invest in'] OUR [product or service], you should be able to [describes business benefit such as, 'save Y amount of money on N operations' or 'ship faster' or 'reduce your operating expenses by X percent'] ."

NOTE: If you hear that statement coming out of the mouth of any of your IT vendors, then for sure you will want to get out your ROI calculator and pin them down to some real hard numbers to be used for post-purchase evaluation.

Pinning Down the ROI Numbers

Remember! In getting to an estimated ROI, it is far more important to be approximately right, because the estimate is never going to be exactly right anyway. So, spending long and agonizing hours trying to pin down a number that will be precisely wrong is a huge waste of time.

You need to estimate five variables to get to your project’s ROI. Pick a period of time for the evaluation period—say, a year, or two years. Then work out values for the following:

- Revenues – How much will our revenues change (increase, generally) over the evaluation period?

- Truly Variable Costs (TVCs) – How much will our TVCs change over the evaluation period? Sticking with easily calculated TVCs keeps your finance people from wandering off into complex algorithms about cost or expense allocations that throw a monkey-wrench into the works with every incremental change in units sold or other variable under consideration. Make sure you have narrowed this number to the REAL TVC value.

- Throughput – This is an easy calculation. It is the change in Revenues less the change in TVCs.

- Investment – How much will our investment change as a result of this project? Investment includes what you are spending on the project itself; but it must also include any other change in investment that may result from the project’s effects. Such changes might be increases or decreases in inventory; the need to add new offices, warehouse or production space and equipment; or, on the contrary, a reduction in investment that may accrue because a new office or warehouse does not need to be purchased or built because of added efficiencies or alternative approaches are undertaken.

- Operating Expenses – How much will our operating expenses change as a result of this project?

Besides the estimated values—or, perhaps in the course of creating the estimates for these values—you should carefully document the 'why' (the rationale) behind each estimate. Write down, as precisely as you can...

- How and why the project under consideration will lead to increased revenues

- How and why the project under consideration will lead to changes in TVCs

- How and why the project under consideration will lead to changes in investment

- How and why the project under consideration will lead to changes in operating expenses

Be Relentless in Your Drive for "Hard Numbers" and the Underlying Rationale

For each of these, be as specific as possible. This will help you keep the project on track as you move forward.

For example: if an IT initiative in business intelligence is supposed to increase revenues by X percent, then the "how and why" should say something long the lines of:

"Improved analytics will allow us to segment our market and dynamically identify market segments where carefully constructed targeted offers (so-called "Mafia offers") and value-pricing are expected to add $2.2 million to revenues in the first year and $3.8 million in year two of the evaluation period."

Make the people asking for the "investment" tell you very specifically how the investment is going to pay-off. Make them tell you, whether they are in-house people, or salespeople from a vendor or VAR (value-added reseller). Don't let them get by with "rules of thumb" and other mumbo-jumbo.

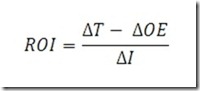

Now, Use This Simple Formula To Calculate Your Projected ROI

Where…

- delta-T = the change in Throughput

- delta-OE = the change in Operating Expenses

- delta-I = the change in Investment

There you have it. Just remember these simple matters…

- Separate OE projects from business improvement projects

- Be relentless in seeking valid estimates and document the underlying rationale for the estimates provided

- Remember that being approximately right is the goal, not precisely wrong

We would like to hear from you. Let us know what you think by leaving a comment here, or contact us directly, if you choose.

REFERENCES

Gerneglia, Bill. "CFOs Require Proof of IT Investment ROI." MyCIOview. MyCIOview, 18 Mar. 2013. Web. 19 Mar. 2013.