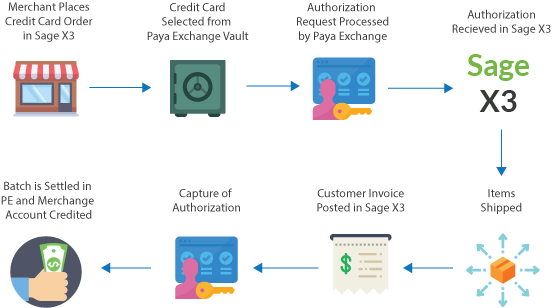

Accepting customer credit cards in Sage X3 is easier with PAYA. PAYA credit card processing for Sage X3 results in efficient Accounts Receivable payment processing and provides customers with additional payment options.

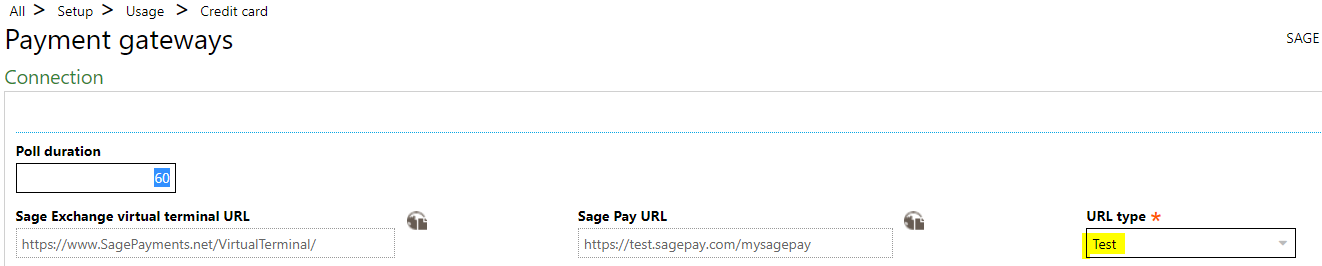

Let’s take a look at the credit card process and flow in Sage X3. An understanding of the flow is essential before implementing the solution, fortunately the integration provides flexibility to implement credit card processing in a test environment before moving to production. PAYA provides the option to request separate test and production accounts. The type of URL (test or production) is setup within the payment gateway function.

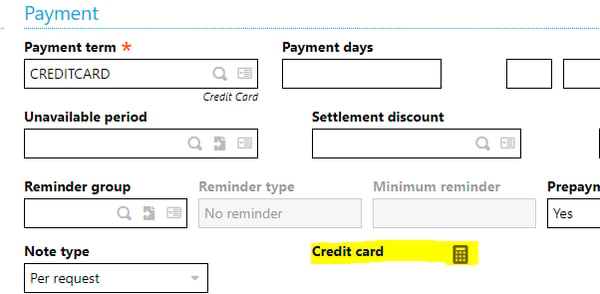

The user friendly processing interface gives users the ability to store credit card information for specific customers securely to expedite processing. Each BP (Customer) can have multiple cards, however, a default credit card is assigned to the customer that automatically loads when processing a credit card payment to speed up the process.

The credit card information is safely stored in the Sage exchange vault. This is found under payment section in the financial tab of Common Data > BPs > Customer.

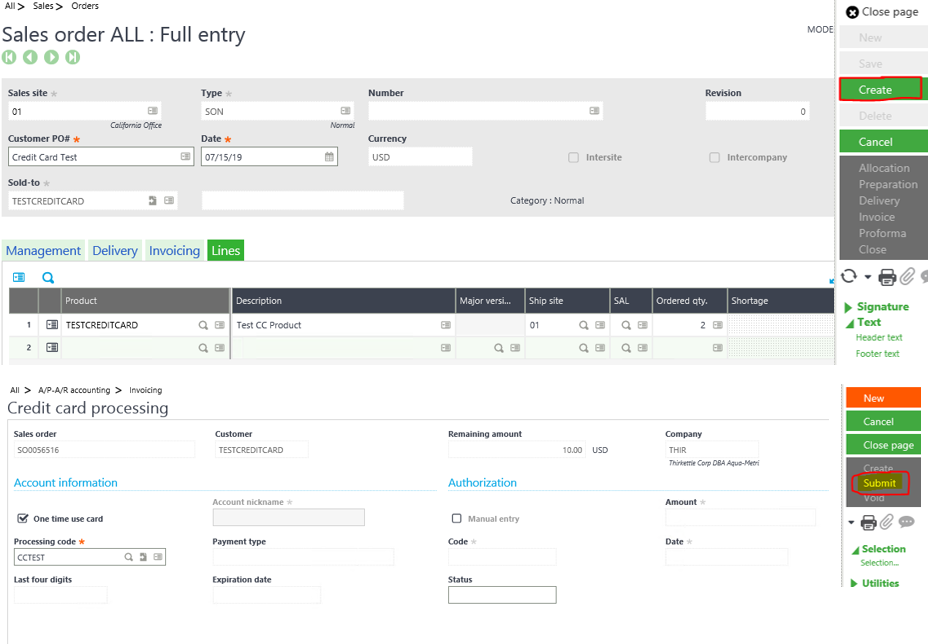

If the user is not using a customer stored credit card, they can select a one-time use card option if desired. In our example, the one-time option is selected and a test PAYA VISA credit card number was used.

Credit cards can be processed in different ways in Sage X3 with PAYA. This example shows the end-to-end credit card process starting with a Sales Order. Other methods include: processing credit cards quickly by creating a Customer BP Invoice and Credit Card Receipt Entry or creating / posting a direct Credit Card Receipt Entry. The Sage X3 credit card processing method will differ based on the situation and business process.

Within Sage X3, create a Sales Order under Sales > Orders > Sales Orders. After creating the order, the credit card processing screen displays. Either a stored card or a one-time use card can be used.

After clicking submit, the user will be directed to the PAYA credit card processing screen. Here, the card number and expiration date is entered for processing. Please note: pop ups on the browser setting must be set to allow.

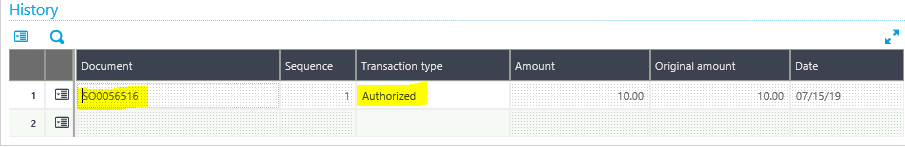

At the Sales Order creation level, the status of the credit card transaction will be authorized if the card is accepted. The history section is displayed at the bottom of the credit card processing screen. This displays the sales order number, the transaction type, the total amount, and the transaction date.

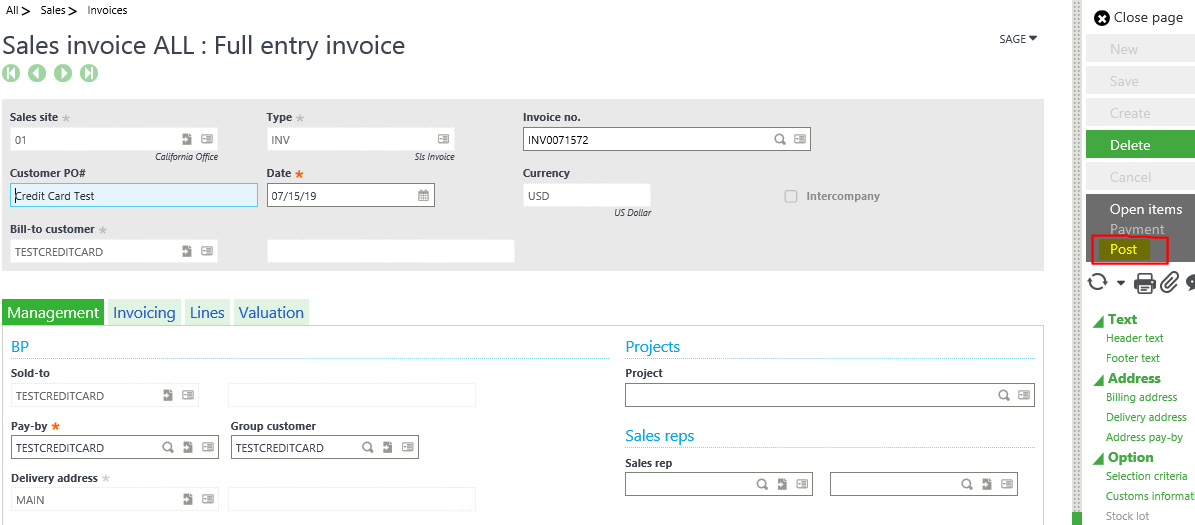

The next step is to create and post the sales invoice. Depending on the business process, the user may need to create and validate a sales delivery before invoicing. Posting the Sales Invoice will capture and process the credit card transaction. In addition, the credit card receipt will be created.

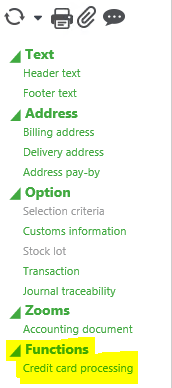

To review the status, go back into credit card processing and verify that the status has been updated. Note: the credit card processing screen can be accessed in the right panel of the Sales Invoice screen under Functions.

After the Sales Invoice has been posted, the document states the credit card receipt transaction number and the transaction type is now captured.

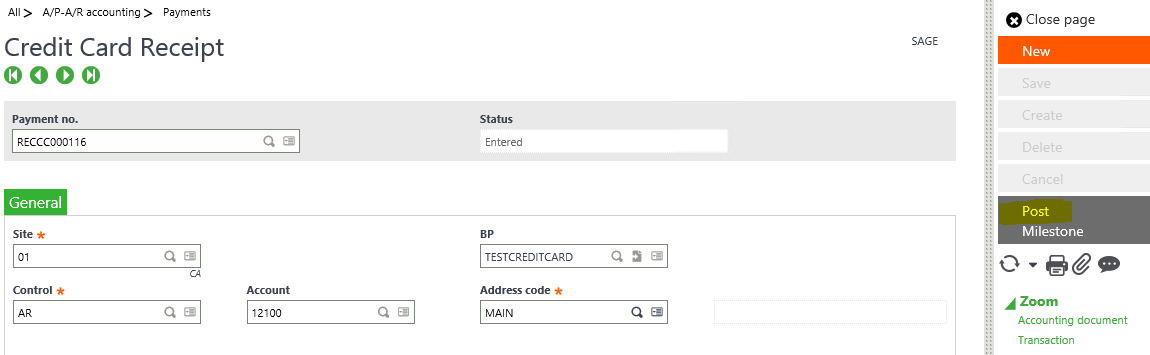

After this, navigate to the credit card receipt entry (RECC000116) and click “Post.” The bank posting function can be used to post a range of receipts.

After posting, the status changes to “In the bank.” Now one can reconcile the transaction under A/P – A/R Accounting > Bank transactions > Bank Reconciliation.

Reports and inquiries for credit card transactions are also available. Download our whitepaper BALNK for a more detailed version of this blog .

PAYA accepts all payment types and supports multi-currency processing. Adding the PAYA credit card processing solution to Sage X3 is feasible and cost efficient. The end-to-end Sage X3 Credit Card processing steps are easy and efficient so anyone can implement Sage X3 credit cards today! Please contact RKL eSolutions today if you have any questions or need help with the transaction process.