JULY 2024 UPDATE:

Effective July 1, 2024, the Colorado Retail Delivery Fee (Colorado RDF) will increase from $0.28 to $0.29.

For more information, read this blog from Avalara: "Colorado may simplify retail delivery fee requirements"

JULY 2023 UPDATE:

Effective July 1, 2023, the Colorado Retail Delivery Fee (Colorado RDF) will increase from $0.27 to $0.28.

For more information, read this blog from Avalara: "Colorado may simplify retail delivery fee requirements"

Beginning July 1st, 2022 Colorado will impose a $0.27 retail delivery fee on all deliveries by motor vehicle to a location in Colorado. The fee is per order and applies if there is any taxable item in the order. Wholesale or other exempt sales are not subject to this fee.

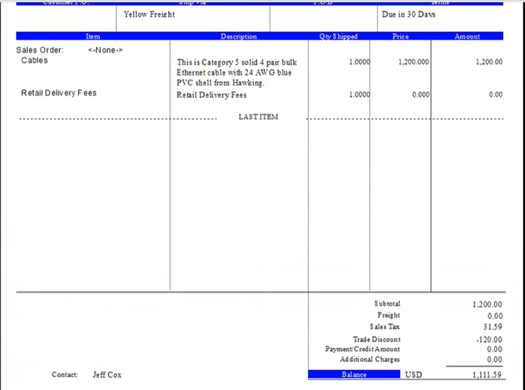

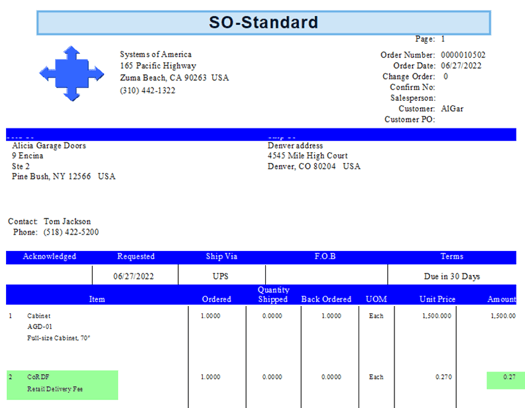

The fee is displayed on the sales invoice. It is charged to the customer by the retailer and that retailer is liable to collect the fee and remit the total of all fees due on a new return, DR 1786.

More information can be accessed at the Colorado Department of Revenue website: https://tax.colorado.gov/retail-delivery-fee

The following steps will walk through how to setup this fee in Sage 500 if you are using 500 to calculate taxes or Avalara AvaTax [Jump to AvaTax Directions].

Non-Avalara environments

The following will work for tracking the (CoRDF) if you are using the Sage 500 and manually adding lines (or have an automated way of adding lines) and are not dependent on an outside service such as Avalara for tax reporting that might have different requirements.

The process would work like excise taxes on many items, and other special fees collected.

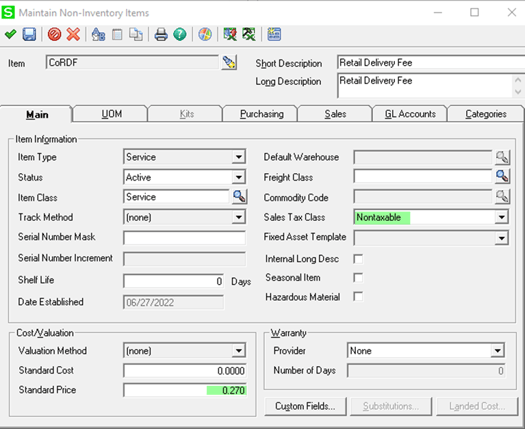

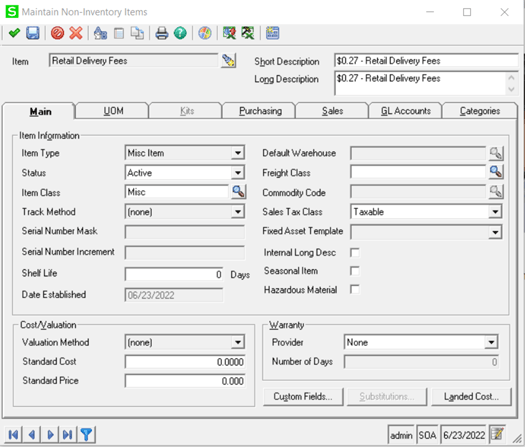

Create a new item – CoRDF or other ID, with a description of Retail Delivery Fee.

- The item can Service or Misc Item

- It should be set to a non-taxable sales tax class. You don’t want to charge tax on tax.

- The standard price should be $0.27.

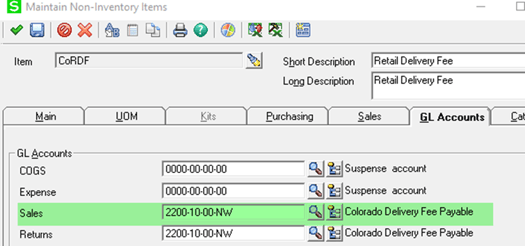

- The GL account for sales and returns should be a current liability account.

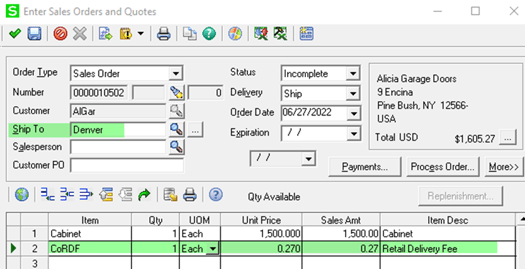

For Colorado, the CoRDF item will need to be added to the sales order (or in Invoice Entry).

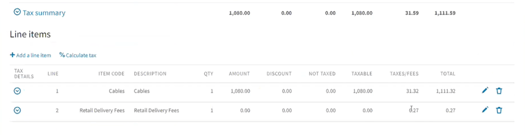

The sales order and the invoice will show the Retail Delivery Fee separately as a line item.

The Retail Delivery Fee will not appear on the “sales tax reports” in Sage 500.

It will show in GL reports.

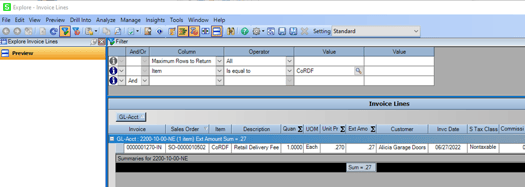

Also the Invoice Lines Explorer will give both count (if needed for the report) and the dollar amount for the reporting period by selecting either the item or the GL account.

Avalara Avatax environments

Create the non-inventory item as a Misc Item

Go to Common Information > Maintenance > Maintain Non-Inventory Items

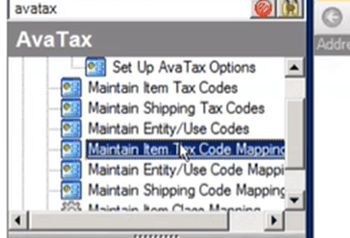

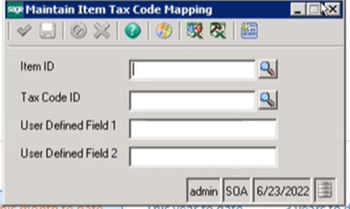

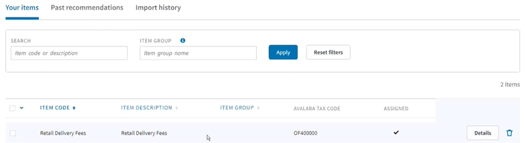

You can add the item to Avalara using the Maintain Item Tax Code mapping task or in Avalara.

In Avalara:

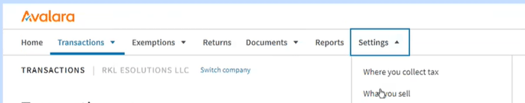

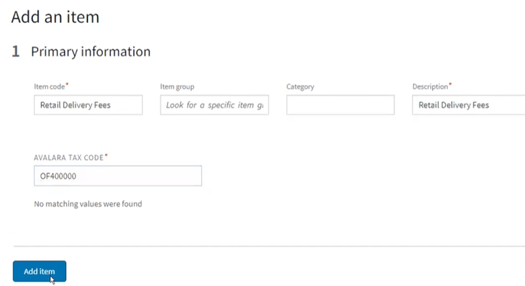

Go to Settings > Select ‘Add an Item’

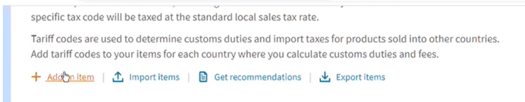

Enter the item and assign to Avalara Tax Code: OF400000. Click on ‘Add item’.

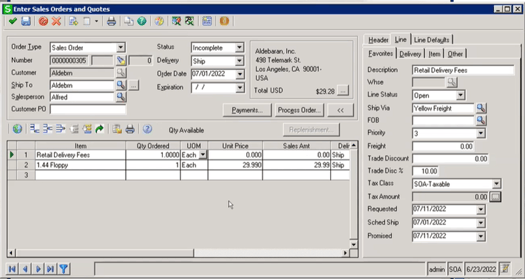

When entering a sales order you will add the item to the sales order for those orders shipping to Colorado and require the tax.

Avalara will display the fee for the order: