Preparing for Data Breach

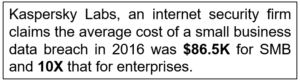

Storing data, whether customer or proprietary, is a key part of any organization. As the reliance upon computers and networking has become essential for businesses to remain competitive, it comes with a new set of challenges. Providing advanced internal and external security controls is now a minimum expectancy for data security. However, no system or network will ever be completely invulnerable. Because of this, businesses must be prepared in the event of a data breach. Insurance is a common necessity for any organization, to ensure their survival if a disaster were to occur. With the growing threat of cyberattacks against businesses, the need for cyber liability insurance is quickly becoming a requirement.

See also: Cybersecurity Assessment Services

The ability to securely utilize and transfer this data may determine whether a business will survive and prosper. A loss of this information, whether accidental or by malicious means, can have severe and permanent consequences. Along with the immediate loss of the monetary valuation of the data, there can be significant damage to consumer confidence. Companies are expected, both publicly and legally, to safeguard information in the interest of itself and its customers. There are thousands of known attacks and breaches on a daily basis, and far more that go unnoticed for months or years. Cyber insurance is the most effective way for an organization to be prepared and compensated for its losses.

What is Cyber Insurance

Acquiring cyber liability insurance is quite similar to any other form of insurance. The provider must first determine the level of security and risk a business faces, as well as the type and value of the data that is being protected. Expectedly, a high-risk and/or high-value data may be more expensive to cover but can provide a much greater reimbursement if it is damaged, lost, or stolen. Types of coverage will usually include:

- Data loss

- Network interruption/downtime

- Privacy liability

- Cost of investigation

- Fraud

- Third-party loss

- Theft

- Cost of customer notification

- Disaster recovery

It is estimated that roughly 60 % of small and medium businesses close within six months following a major data breach. This is more relevant now than ever, as every day brings new headlines or discovered attacks, breaches, and vulnerabilities. Most recently, the widespread Spectre and Meltdown Vulnerabilities are a perfect example. Either of these could allow an attacker access to information stored on a device or network, and have already affected hundreds of millions of devices worldwide.

The best preparation against a data breach is initially prevention, using strong security measures and a defense-in-depth strategy. It is far less expensive to invest in adequate network and information security controls than it would be to recover from a data breach. However, even the most thorough network security is not full-proof; cyber liability insurance provides the ability to cover the unforeseen and unpredicted losses.

Have Questions or Need Help?

If your organization needs assistance in identifying and mitigating security risks, click below to get in touch with us and we can provide the necessary IT and Risk Management services to help ensure the security of your IT infrastructure.

If your organization needs assistance in identifying and mitigating security risks, click below to get in touch with us and we can provide the necessary IT and Risk Management services to help ensure the security of your IT infrastructure.

Cybersecurity Help