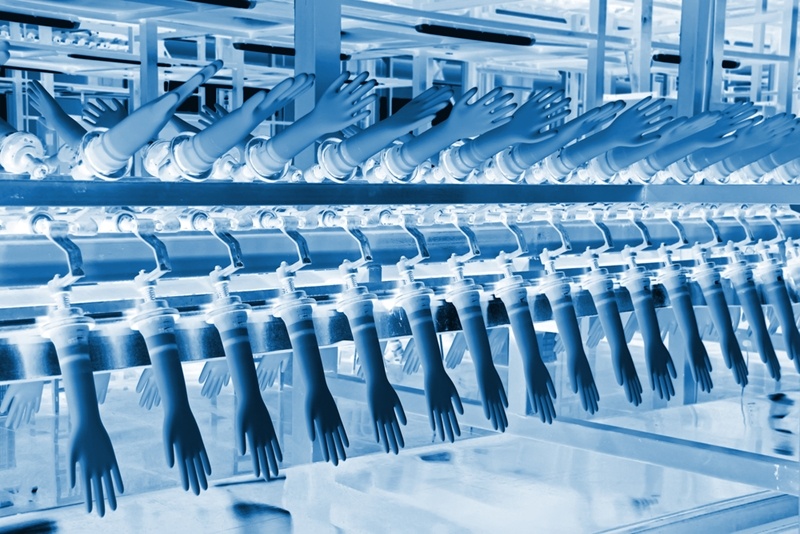

Manufacturing is a field in constant flux. While many of us still imagine traditional assembly lines, aproned workers and manual activities (e.g., welding or picking and placing objects into containers) when we hear the word "manufacturing," today's factories are markedly different than their predecessors. Versatile robots and purpose-built deterministic industrial Ethernet networks are as much a part of their operations as quality assurance experts and old-fashioned conveyer belts.

Indeed, new hardware and software have made major inroads into manufacturing, changing not only how goods are made but also what type of labor is required during their production. In 2014, the U.S. Bureau of Labor Statistics cited technology as a key contributor to the decline in overall manufacturing employment in recent decades, with many positions becoming obsolete or low-demand.

But while plant floors have been sites of major innovations for both processes and tools, this same spirit hasn't always carried over to the back offices in which the company books are balanced. Accountants at manufacturers of all stripes continue to struggle with tasks such as revenue recognition, inventory management and industry-specific issues.

The situation isn't improved by widespread reliance on spreadsheets, legacy desktop software and expensive on-premises enterprise resource planning systems. Manufacturers are increasingly turning to cloud accounting software as well as cloud ERP solutions to streamline their financial processes.

Understanding some of the current challenges in accounting for manufacturers

Accountants at manufacturing companies have unique responsibilities in addition to the ones traditionally associated with their profession. For example, they have to stay on top of inventory valuation and revenue recognition of goods sold, to a much greater degree than their counterparts in other industries.

Inventory and recognition

Let's start by examining the challenges of inventory in particular in a bit more depth, to see what finance teams here are up against. Whereas a software vendor or marketing firm has little if anything in the way of traditional inventory, manufacturers work with everything from raw materials to finished durable goods. Accordingly, their accounting processes have to incorporate specific procedures such as overhead and direct cost assignments, along with impairment testing.

Impairment testing determines whether the inventory cost is aligned with current market values. It may require write-downs if the recorded cost is higher than the market rate. Meanwhile, direct (e.g., labor and materials) and overhead costs can often complicate accounting practices in ways that are unique to the manufacturing industry.

"The stakes are high when it comes to inventory valuation."

"Fixed manufacturing overhead costs present certain problems in determining product cost and operating profit (that is, profit before interest and income tax expenses)," explained the author of the blog, Dr. T's Accounting Problems and Tax. "Manufacturing overhead consists of costs that are indirectly associated with the making of a finished product. These costs may also be manufacturing costs that cannot be classified as direct materials or direct labor."

The stakes are high for doing inventory valuation the right way. Addressing the other big manufacturing-specific issue we touched upon earlier - i.e., recognition of goods sold - is highly dependent on accurate inventory-related processes. Accounting teams also have to keep an eye on numbers such as excessive scrap or other abnormal potential costs.

Outmoded financial tools and processes can get in the way of improvement

On top of the challenges inherent in these particular procedures, there is additional pressure on accounting teams due to their inefficient tools and processes. Relying on on-premises software or manual, spreadsheet-driven workflows can lead to troubles such as:

- High inventory levels and associated carrying costs

- Delays in product delivery

- Inaccurate production schedules

- Low gross margins, due to incorrect production cost data

- Difficulty sharing information with colleagues

For this reason, manufacturers everywhere stand to benefit by switching to cloud-based alternatives. These platforms provide a strong technical foundation for streamlining company finances and making life easier on accountants.

How the cloud simplifies accounting and ERP for manufacturers

What does the cloud do for finance teams at growing manufacturers? For starters, a cloud accounting system is easy to set up and manage. Its infrastructure is constantly tended to by the cloud service provider, which oversees all system and security updates. Struggling with hardware and software upgrades becomes a thing of the past.

Beyond that, cloud solutions offer straightforward access from virtually any type of Internet-enabled device, without the need for complex terminal servers or workarounds. The total amount of supporting infrastructure needed for cloud software is minimal compared with any would-be on-prem equivalent. This lightweight setup makes the cloud an especially good fit for small, medium-sized and rapidly growing manufacturers.

Many manufacturers need a hand with their financial processes.

Similarly, the cloud provides a cost-effective and automated framework for ERP as well. While manufacturers are always seeking ways to boost profitability, the steep initial investment required to start up a traditional ERP system - e.g, server purchasing and maintenance - can derail this goal. Cloud ERP reduces this CAPEX, turning it into the OPEX of a subscription, and also offers superior visibility into processes such as supply chain management.

Shifting financial operations to the cloud is now the right move for many manufacturers. The complexity of their accounting requirements, coupled with the rapid changes in their industry means, that they can no longer afford to be laggard when it comes to balancing their books. Cloud software ensures that they do not. It provides a rock-solid base from which to build efficient financial processes, boost the accuracy inventory valuation and improve overall margins.