Inc. Navigator CEO Brent Sapp points out, "Leadership consistency is a second-stage challenge that impacts nearly all companies as they move through the no-man's-land from startup to the middle market." ("BUILD: A Game Plan for Alignment." Inc. Magazine, November 2013)

These findings are entirely consistent with a study done more than a decade ago and published in the Harvard Business Review, where it was found that a great many companies struggled, and even foundered, in the uncharted waters between the strong (typically) singular leadership and vision of one person, during the early days of a startup, and the team leadership demanded as a business begins to move into enterprise status in the middle market.

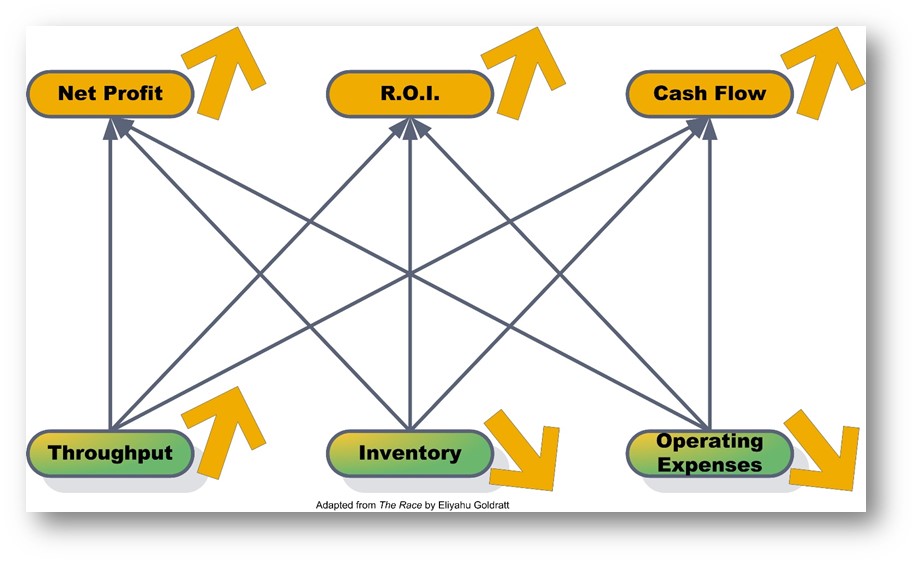

Entrepreneurial "Analytics"

Even without being (necessarily) able to articulate the matter in these precise terms, entrepreneurs spot an opportunity in the marketplace and make some very quick calculations—often calculating in very round numbers and doing so in their heads. Again, without necessarily using these terms, their calculations are generally along these lines:

P = (R – TVC) – OE Where P = Profit, R = Revenue, TVC = Truly Variable Costs, OE = Operating Expenses

In the early stages, in many cases, this calculation is made all the easier because their operating expenses (OE) are zero or near zero. So, the calculation for any given period of time into the future becomes P = R – TVC, period.

If some not insignificant investment is involved, this calculation—still simple enough to be done in the coffee shop on a napkin—becomes:

ROI = ((R – TVC) – OE) / I

Where, I = Investment

(See more on Throughput accounting here.)

Alignment for Rapid Improvement and Growth

When faced with new opportunities for growth or improvement (better profits on existing business), these same entrepreneurs can rapidly adjust this formula for calculating the benefit of a potential change in operations. This formula becomes, then, over any given period of time into the future:

ROI = ((DR - DTVC) - DOE) / DI

Read as: ROI (on the proposed change) = (estimated change in R – estimated change in TVC – estimated change in OE) / (estimated change in I)

Here again, for those operating in entrepreneurial mode, these calculations can frequently be done very rapidly—scratched out on a napkin, or even done in their heads. Somewhat more complex scenarios may call for invoking the aid of Microsoft Excel or some other tool. But, most entrepreneurs operate unencumbered by some desperate and vain attempt to make the forecast numbers accurate to the dollar or the penny. Instead, they may be satisfied with numbers that are "approximately right," being rounded to $1,000s or $10,000s.

Amazingly, these off-the-cuff, approximations guide the company successfully through its embryonic stages and beyond. Oftentimes, decisions made on these guess-timates lead to huge leaps in growth and the leveraging of outstanding opportunities for improved profits.

Relevance Lost

As a company grows from its entrepreneurial roots into the midmarket, it becomes necessary to have a more comprehensive accounting system and people to manage it. As more and more data become available, the management team tends to move away from the simple factors that guided their decisions in the past. Now, suddenly, they feel compelled to start categorizing what used to be OE into "fixed" and "variable"—even though it most of it (perhaps, all of it) is not truly variable with changes in revenues at all.

As Johnson and Kaplan articulated so well: "[A]n ineffective management accounting system can undermine superior product development, process improvement, and marketing efforts. Where an ineffective management accounting system prevails, the best outcome occurs when managers understand the irrelevance of the system and by-pass it by developing personalized information systems. But managers unwittingly court trouble if they do not recognize an inadequate system and erroneously rely on it for managerial control information and product decisions." (Johnson, H. Thomas, and Robert S. Kaplan. Relevance Lost - The Rise and Fall of Management Accounting. Boston, MA: Harvard Business School Press, 1991.)

The emphasis here is on "the best outcome occurs when managers understand the irrelevance of the system and by-pass it by developing personalized information systems."

Continue with What Works

Instead of trying to improve the accuracy and finiteness of their "estimates" regarding actions they might take for improvement or to leverage new opportunities, they should by-pass the complexity of their ERP system's calculations (which are great for GAAP-compliant reporting) and continue to use "approximately right" numbers that are close enough to gauge whether a new opportunity for profit or improvement is likely to yield a solid ROI.

If, based on well-considered estimates rounded to $1,000s or $10,000s (or higher, in some cases) are predicated on sound strategies and tactics that can be clearly articulated by the team, then if the P (Profit) or ROI (Return on Investment) is positive and significantly positive, it is probably an opportunity worth pursuing.

On the other hand, if the value of P or ROI is very low—near zero or only marginally above zero—then it makes sense for the management team to look elsewhere for opportunities for growth and improvement, rather than risking its precious commodities of management time and attention, energy and capital on what will likely produce marginal positive results—if any.

Conclusion

Entrepreneurs build a successful enterprise based on calculations that are big, bold and based on "approximately right" estimates of R, TVC, OE and I. When they attempt to leap the chasm from entrepreneurial to enterprise, they frequently become encumbered with attempts to make precise calculations that will, in any event, end up being "precisely wrong." Typically, these midmarket management teams struggle to make these calculations based on the details and numbers available to them from the ERP systems.

Unfortunately, "Today's management accounting systems provide a misleading target for managerial attention and fail to provide the relevant set of measures that appropriately reflect the technology, the products, the processes, and the competitive environment in which the organization operates." (Johnson and Kaplan, ibid)

Moving back to the simplicity of easy-to-calculate and reliable round numbers will actually deliver more reliable predictions of the outcome of opportunities for growth or improvement than the "precisely wrong" calculations made using complex systems.

Let us know your thoughts on these matters. If you have questions, do not hesitate to contact us. Leave your comments below.