Building an A-List Accounting Team

This blog post is a continuation in our series designed to help growing entertainment companies recognize and overcome some of the most common challenges in corporate accounting and finance. For related topics, click on the links below:

- Building block #3: Account groups

Improve Visibility into All Aspects of Your Operations with Sage Intacct Reports & Dashboards

Challenge

As discussed in former blog posts, growing entertainment companies typically face various accounting difficulties because they’re always adding more! More projects result in more entities. More entities = more stakeholders, which leads to more detailed reporting requirements. And, inevitably, more detailed reporting requirements lead to more reports and more GL accounts.

In entry-level accounting solutions (e.g., QuickBooks) or legacy solutions such as Microsoft Great Plains, adding accounts to existing reports is often tedious and time-consuming, because every report has to be manually modified with the new account .

Solution

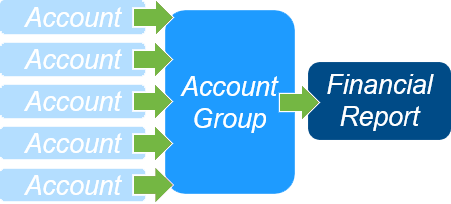

Sage Intacct account groups provide a much more dynamic and flexible way to organize your accounts and ensure that new accounts are added automatically to existing reports. Account groups become your fundamental building blocks of financial reporting.

Here’s a brief description of how it works:

- The Account Groups feature in Intacct’s General Ledger module allows users to create an unlimited number of “groups” and assign GL accounts to one or more of these categories. You may either select them individually or in a range.

- Account categories are predefined in the General Ledger module and include the following types: assets, liabilities, equity, revenue, cost of sales, expenses, other income and expense, income tax, and non-financial.

- Each category also includes a set of predefined account types and cash flow types that you can select to further define the group. This information determines how each account is handled for reports, subtotals, and the year-end balance,

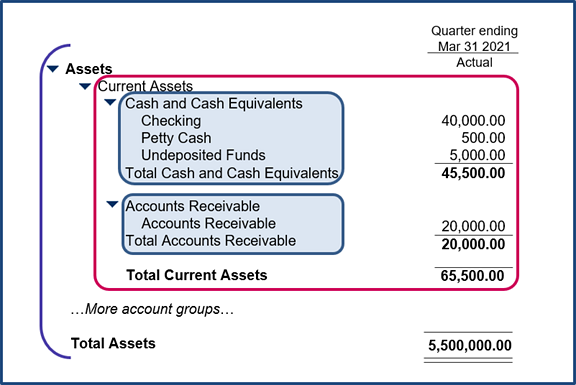

- and the account group description is used as a heading on various reports, such as the Trial Balance and Financial Reports.

Success:

Our friends at Legendary have created over 60 custom reports to provide the information and insight they need to strategically manage their global entertainment company. Account groups are an important part of ensuring that reports are accurate with any and all changes to the chart of accounts.

Benefits

Account groups provide a number of benefits for your reporting needs:

- By assigning new accounts to an account, you can know that any new account will be properly added to the correct reports

- Reports are organized in a hierarchical fashion for improved understanding

- Account groups can be shown in summary or detail simply by clicking on the little triangle to the left of the account group title

The diagram shows several account groups – assets , current assets, cash and cash equivalents, and accounts receivable.

For more information on how you can benefit from Sage Intacct account groups and other building blocks of reporting magic, please contact RKL. We’d love to chat about your current reporting challenges and consider how Sage Intacct can transform what is manual and unreliable to that which is real-time and strategic.